HI DoT GEW-TA-RV-5 2014-2024 free printable template

Show details

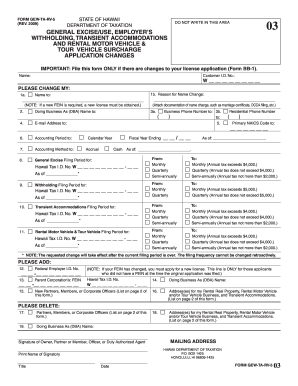

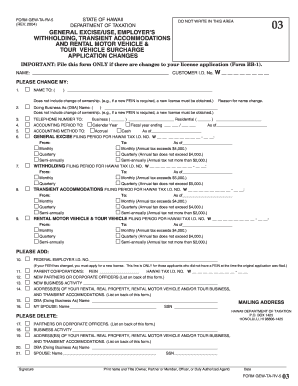

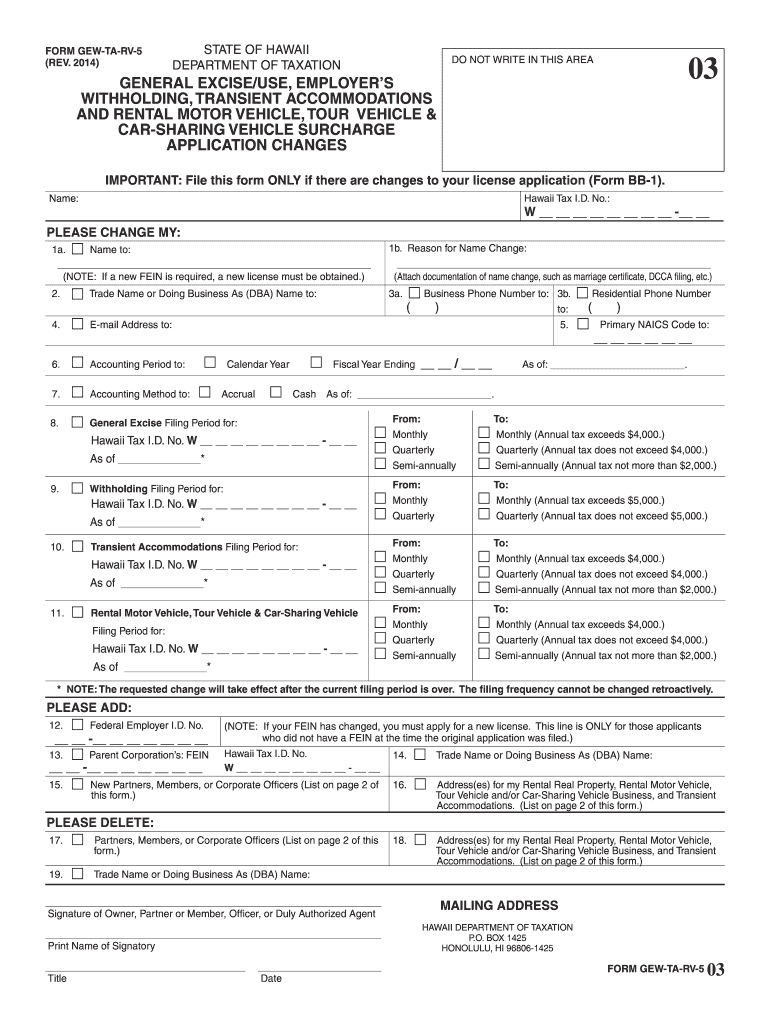

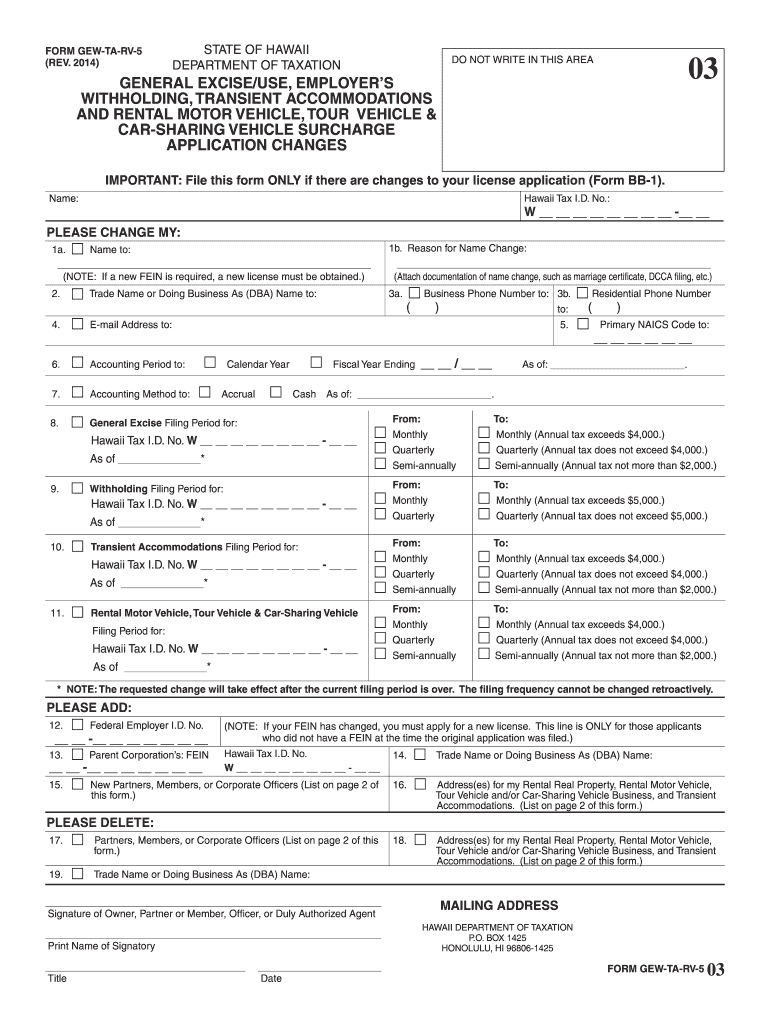

Clear Form FORM GEW-TA-RV-5 REV. 2014 STATE OF HAWAII DEPARTMENT OF TAXATION DO NOT WRITE IN THIS AREA GENERAL EXCISE/USE EMPLOYER S WITHHOLDING TRANSIENT ACCOMMODATIONS AND RENTAL MOTOR VEHICLE TOUR VEHICLE CAR-SHARING VEHICLE SURCHARGE APPLICATION CHANGES IMPORTANT File this form ONLY if there are changes to your license application Form BB-1. Name Hawaii Tax I. D. No* W - PLEASE CHANGE MY 1a* 1b. Reason for Name Change Name to Attach documentation of name change such as marriage...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your formgew ta rv 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your formgew ta rv 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit formgew ta rv 1 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit hawaii gew ta rv 1 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

HI DoT GEW-TA-RV-5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out formgew ta rv 1

How to fill out Hawaii GEW-TA-RV:

01

Gather all necessary information and documents, such as your business information, sales records, and tax exemption certificate.

02

Visit the Hawaii Department of Taxation website and navigate to the GEW-TA-RV page.

03

Select the appropriate filing method, whether it's online or by paper.

04

Provide your business details, including your name, address, and taxpayer identification number.

05

Fill out the sections related to your business activities and sales, including the relevant dates and amounts.

06

If applicable, indicate any tax exemptions or credits that apply to your business.

07

Review and ensure all information provided is accurate and complete.

08

Submit the form either online or by mail, following the instructions provided.

Who needs Hawaii GEW-TA-RV:

01

Individuals or businesses engaged in selling tangible goods in Hawaii.

02

Out-of-state sellers who make sales into Hawaii that are subject to the general excise tax.

03

Entities applying for tax clearances or exemptions, such as contractors or nonprofit organizations operating in Hawaii.

Video instructions and help with filling out and completing formgew ta rv 1

Instructions and Help about gew ta rv 5 hawaii form

Fill gew ta : Try Risk Free

People Also Ask about formgew ta rv 1

How often do you have to file Hawaii general excise tax?

How do I get my Hawaii state tax form?

What is the power of attorney form for Hawaii state taxes?

Where can I get Hawaii GE tax license forms?

What is the late penalty for GE tax in Hawaii?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file hawaii gew ta rv?

In Hawaii, every person engaged in business within the state is required to file the General Excise Tax (GET) RV (Reconciliation) form. This includes individuals, partnerships, corporations, and other entities that generate income from business activities conducted in Hawaii.

How to fill out hawaii gew ta rv?

To fill out the Hawaii GEW TA RV form, you can follow these steps:

1. Obtain the Hawaii GEW TA RV form: You can download the form from the Hawaii State Department of Taxation website or obtain a physical copy from their office.

2. Review the form: Familiarize yourself with the form and the instructions provided. Make sure you understand the purpose of the form and the information required.

3. Provide business and contact details: Start filling out the form by providing your business name, address, phone number, email, tax identification number, and other relevant contact information as requested.

4. Enter tax period and filing information: Indicate the tax period for which you are filing the return. Provide the appropriate filing information, such as whether it's an original return, an amended return, or a final return.

5. Gross rental income: Report the gross rental income earned from transient accommodations in Hawaii for the specified tax period. This may include income from vacation rentals, timeshares, bed and breakfasts, and other similar accommodations.

6. Deductions: If applicable, report any allowable deductions related to the rental activity. This could include expenses like property management fees, repairs/maintenance, advertising, insurance, and other legitimate business expenses.

7. Calculate tax liability: Use the provided worksheets or follow the instructions to calculate your tax liability based on the gross rental income and any deductions.

8. Payment: If you owe taxes, ensure you include payment by check or money order payable to the Hawaii State Department of Taxation. Attach the payment to the completed form.

9. Filing: Once you have completed the form and attached any necessary documentation, mail it to the specified address provided on the form. Ensure you keep a copy of the completed form for your records.

Remember, it's always advisable to consult with a tax professional or the Hawaii State Department of Taxation if you have specific questions or concerns about filling out the GEW TA RV form.

What information must be reported on hawaii gew ta rv?

When filling out a Hawaii GEW-TA-RV (General Excise / Use Tax Return for Vendors) form, the following information must typically be reported:

1. General Information: Name, address, and contact information of the vendor.

2. Reporting Period: The specific time period (usually a month or quarter) for which the report is being filed.

3. Gross Proceeds: The total amount of sales made during the reporting period.

4. Taxable Income: The amount of income subject to Hawaii General Excise Tax (GET).

5. Tax Rate: Hawaii's current GET rate, which is 4.5% for most businesses and 0.5% for wholesalers.

6. Tax Liability: The amount of GET owed for the reporting period, based on the taxable income and applicable tax rate.

7. Exemptions and Deductions: Any exempt sales or deductible amounts (such as bad debts) that reduce the taxable income and, subsequently, the tax liability.

8. Other Taxes and Fees: Any additional taxes or fees that may be applicable, such as transient accommodations tax or county surcharges.

9. Schedule GEW-TA-RV-A (Monthly Summary): This schedule is used to summarize the gross proceeds and exemptions for each month within the reporting period.

10. Schedule GEW-TA-RV-F (Exemption Detail): If claiming exemptions, this schedule provides the details of the exempt transactions.

11. Schedule GEW-TA-RV-G (Payments): If payments are being made with the return, this schedule is used to report the payment details.

12. Account Information: Bank accounts information for direct deposit or Electronic Funds Transfer (EFT) purposes, if applicable.

13. Signature: The return must be signed, certifying its accuracy and completeness.

It's important to note that the exact information required on the form may vary depending on the specific circumstances and the most current version of the GEW-TA-RV form provided by the Hawaii Department of Taxation should always be consulted.

What is the penalty for the late filing of hawaii gew ta rv?

There is limited information regarding the specific penalty for late filing of a Hawaii GET (General Excise Tax) RV (Recreational Vehicle) return. It is recommended to consult the Hawaii Department of Taxation for accurate and up-to-date information on penalties associated with late filing of the GET return specifically for recreational vehicles. You can contact them directly or visit their official website for further details.

How can I edit formgew ta rv 1 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing hawaii gew ta rv 1 form.

How do I fill out the gew ta rv form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign form gew ta rv 1 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out hawaii gew ta rv 1 on an Android device?

Complete your form gew ta rv 5 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your formgew ta rv 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gew Ta Rv Form is not the form you're looking for?Search for another form here.

Keywords relevant to gew form blank

Related to nonresident alien

If you believe that this page should be taken down, please follow our DMCA take down process

here

.