HI DoT GEW-TA-RV-5 2014-2026 free printable template

Show details

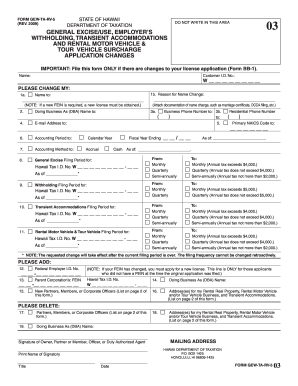

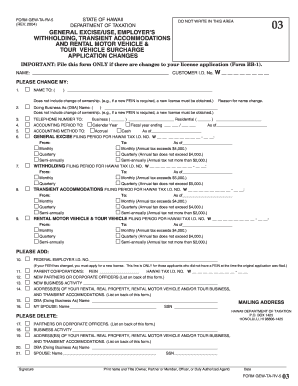

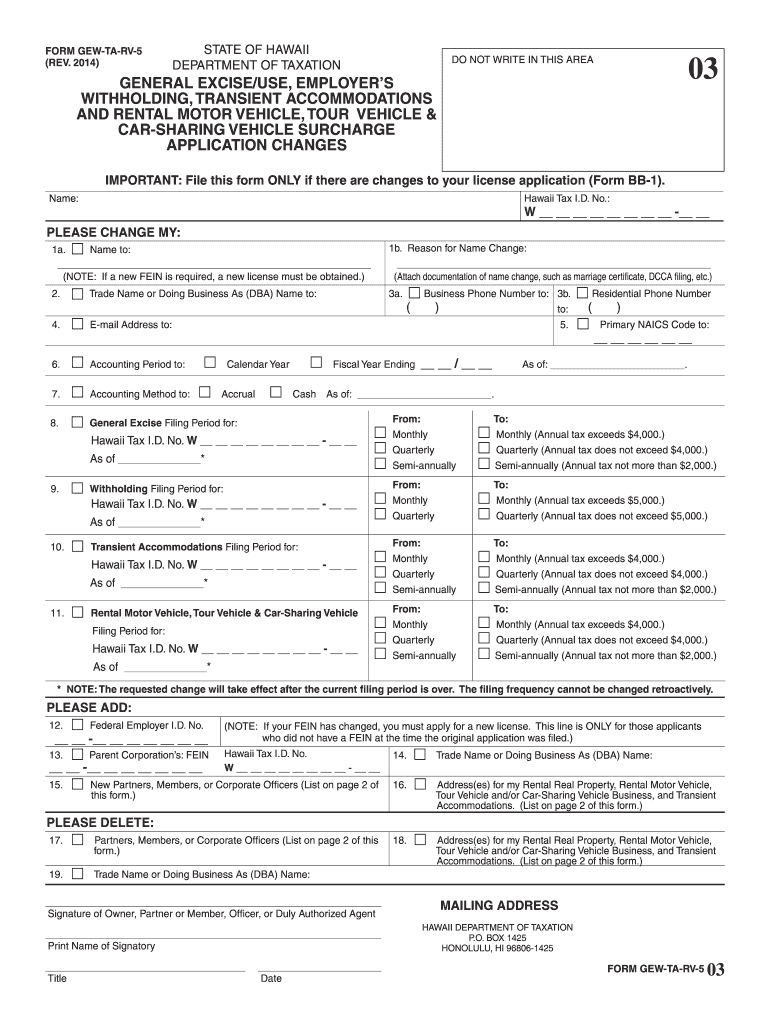

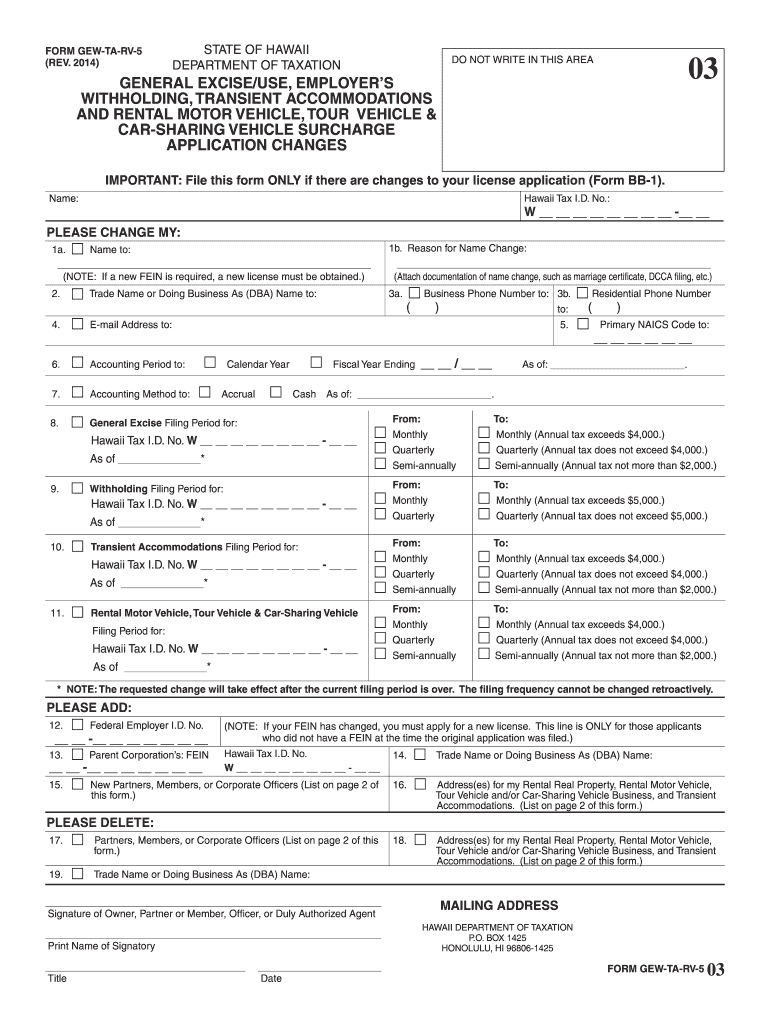

Clear Form FORM GEW-TA-RV-5 REV. 2014 STATE OF HAWAII DEPARTMENT OF TAXATION DO NOT WRITE IN THIS AREA GENERAL EXCISE/USE EMPLOYER S WITHHOLDING TRANSIENT ACCOMMODATIONS AND RENTAL MOTOR VEHICLE TOUR VEHICLE CAR-SHARING VEHICLE SURCHARGE APPLICATION CHANGES IMPORTANT File this form ONLY if there are changes to your license application Form BB-1. Name Hawaii Tax I. D. No* W - PLEASE CHANGE MY 1a* 1b. Reason for Name Change Name to Attach documentation of name change such as marriage...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hawaii excise tax service form

Edit your rv 5 the purpose of hi dot gew ta rv 5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

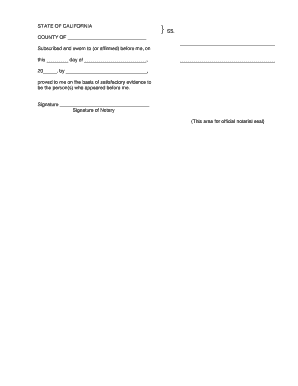

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ge license hawaii form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gew ta rv 1 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ge license hawaii online application form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT GEW-TA-RV-5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ta authorization form

How to fill out HI DoT GEW-TA-RV-5

01

Gather required information including vehicle identification number, mileage, and registration details.

02

Fill in personal information such as name, address, and contact details in the appropriate sections.

03

Provide information about the vehicle's make, model, and year.

04

Include details regarding any modifications or special features of the vehicle.

05

Verify the accuracy of all entries before submission.

06

Sign and date the form as required at the bottom of the document.

07

Submit the completed form to the designated office, either in person or via mail.

Who needs HI DoT GEW-TA-RV-5?

01

Individuals or businesses registering a vehicle in Hawaii.

02

Car dealerships handling vehicle registration for clients.

03

Fleet managers managing multiple vehicles that require registration.

04

Anyone seeking a government-issued title or registration for their vehicle.

Fill

ge license hawaii application

: Try Risk Free

People Also Ask about ge form

How often do you have to file Hawaii general excise tax?

You must file monthly if you will pay more than $4,000 in GET per year. You may file quarterly if you will pay $4,000 or less in GET per year. You may file semiannually if you will pay $2,000 or less in GET per year.

How do I get my Hawaii state tax form?

To request a form by mail or fax, you may call our Taxpayer Services Form Request Line at 808-587-4242 or toll-free 1-800-222-3229.

What is the power of attorney form for Hawaii state taxes?

A Hawaii tax power of attorney (Form N-848), otherwise known as Department of Taxation Power of Attorney, provides a way in which a person can appoint someone, usually an accountant or tax advisor, to represent their interests in front of the Department of Taxation.

Where can I get Hawaii GE tax license forms?

Where else can I obtain a GET license? You may apply in-person at the Business Action Center, which is located at 335 Merchant Street, Suite 201. Office hours are 7:45 a.m. to 4:30 p.m., Mondays through Fridays (except State holidays); telephone number is (808) 586-2545.

What is the late penalty for GE tax in Hawaii?

The penalty for failure to file a return on time is calculated at 5% per month, or part of a month, on the unpaid tax up to a maximum of 25%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ge license on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing hawaii department of taxation rental motor vehicle surcharge tax brochure.

How do I fill out the hawaii ge tax license form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign how to apply for ge license in hawaii and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out get license hawaii on an Android device?

Complete your hawaii get license and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is HI DoT GEW-TA-RV-5?

HI DoT GEW-TA-RV-5 is a specific form used by the Hawaii Department of Transportation for reporting information related to transportation-related activities and compliance in the state.

Who is required to file HI DoT GEW-TA-RV-5?

Individuals or organizations engaged in certain transportation activities in Hawaii, such as vehicle operators and freight carriers, are required to file HI DoT GEW-TA-RV-5.

How to fill out HI DoT GEW-TA-RV-5?

To fill out HI DoT GEW-TA-RV-5, you must provide relevant details such as entity information, transportation activity descriptions, and any necessary compliance metrics as instructed in the accompanying guidelines.

What is the purpose of HI DoT GEW-TA-RV-5?

The purpose of HI DoT GEW-TA-RV-5 is to ensure proper reporting and compliance with transportation regulations, helping the Hawaii Department of Transportation monitor and evaluate transportation activities.

What information must be reported on HI DoT GEW-TA-RV-5?

Information that must be reported on HI DoT GEW-TA-RV-5 typically includes details about the reporting entity, nature of transportation activities, compliance status, and any relevant metrics or thresholds set by regulatory authorities.

Fill out your HI DoT GEW-TA-RV-5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ge Tax License is not the form you're looking for?Search for another form here.

Keywords relevant to excise tax hawaii

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.